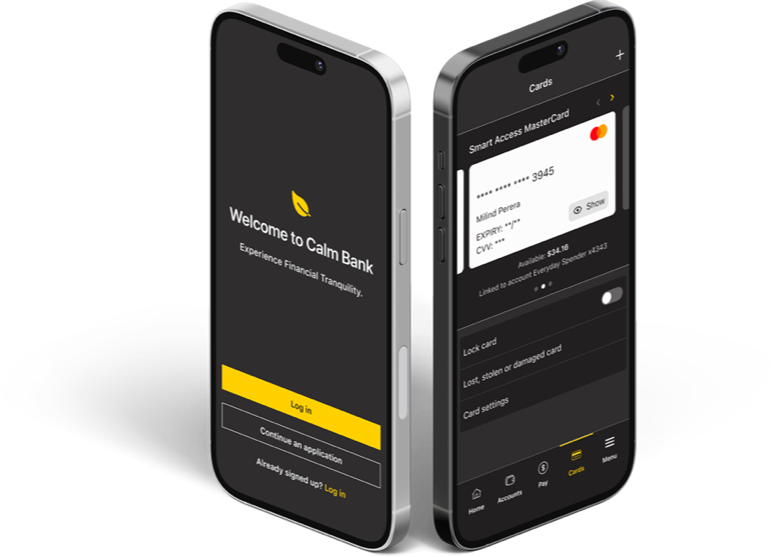

Only invest in your unique features

Why re-invent the wheel?

Don’t spend money on the boring foundational stuff. Use pre-built modules that accelerate and de-risk your project. Save your money and development efforts on the important differentiating features will delight your customers.

Better experience

Decrease cost

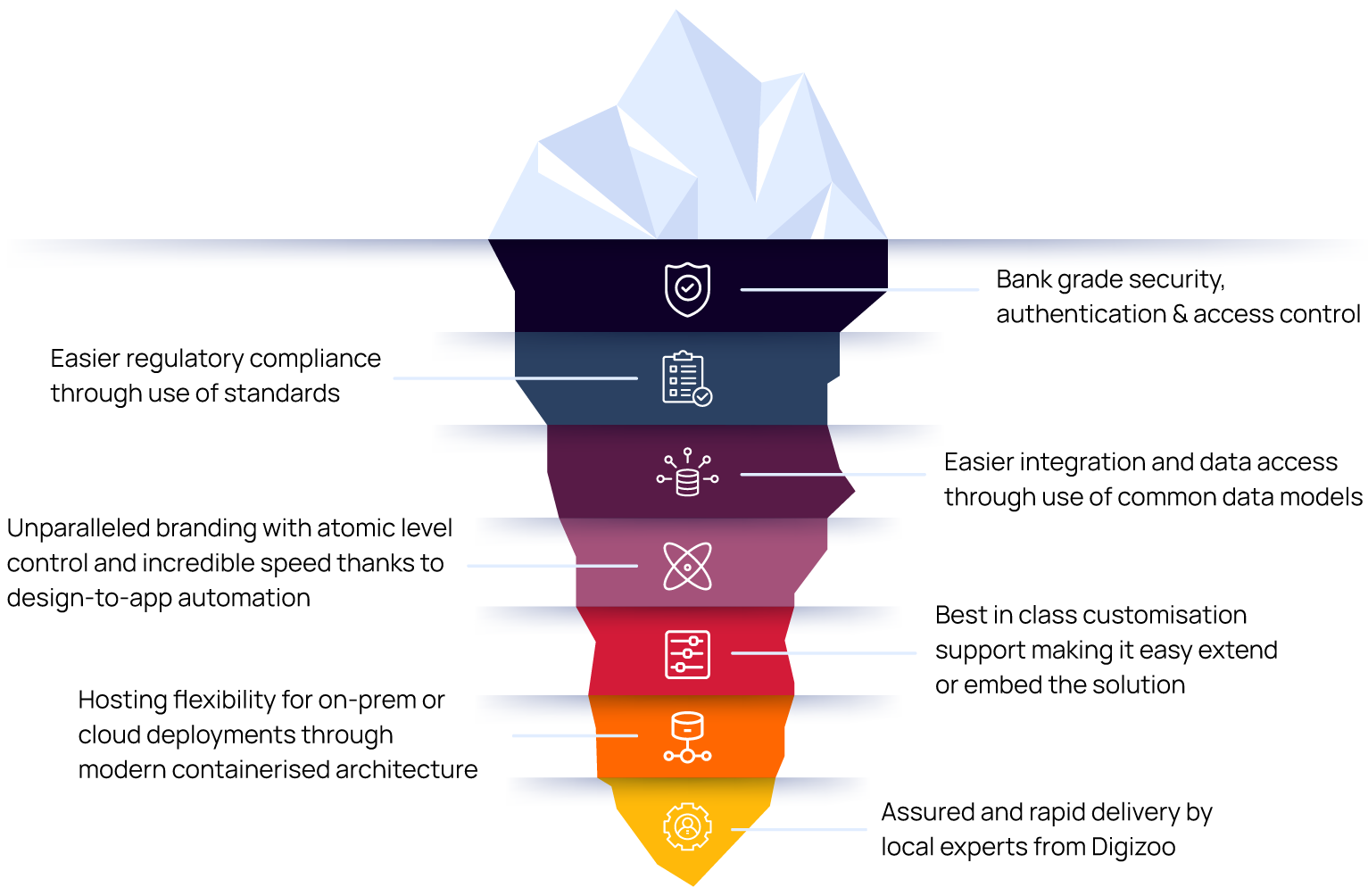

How?

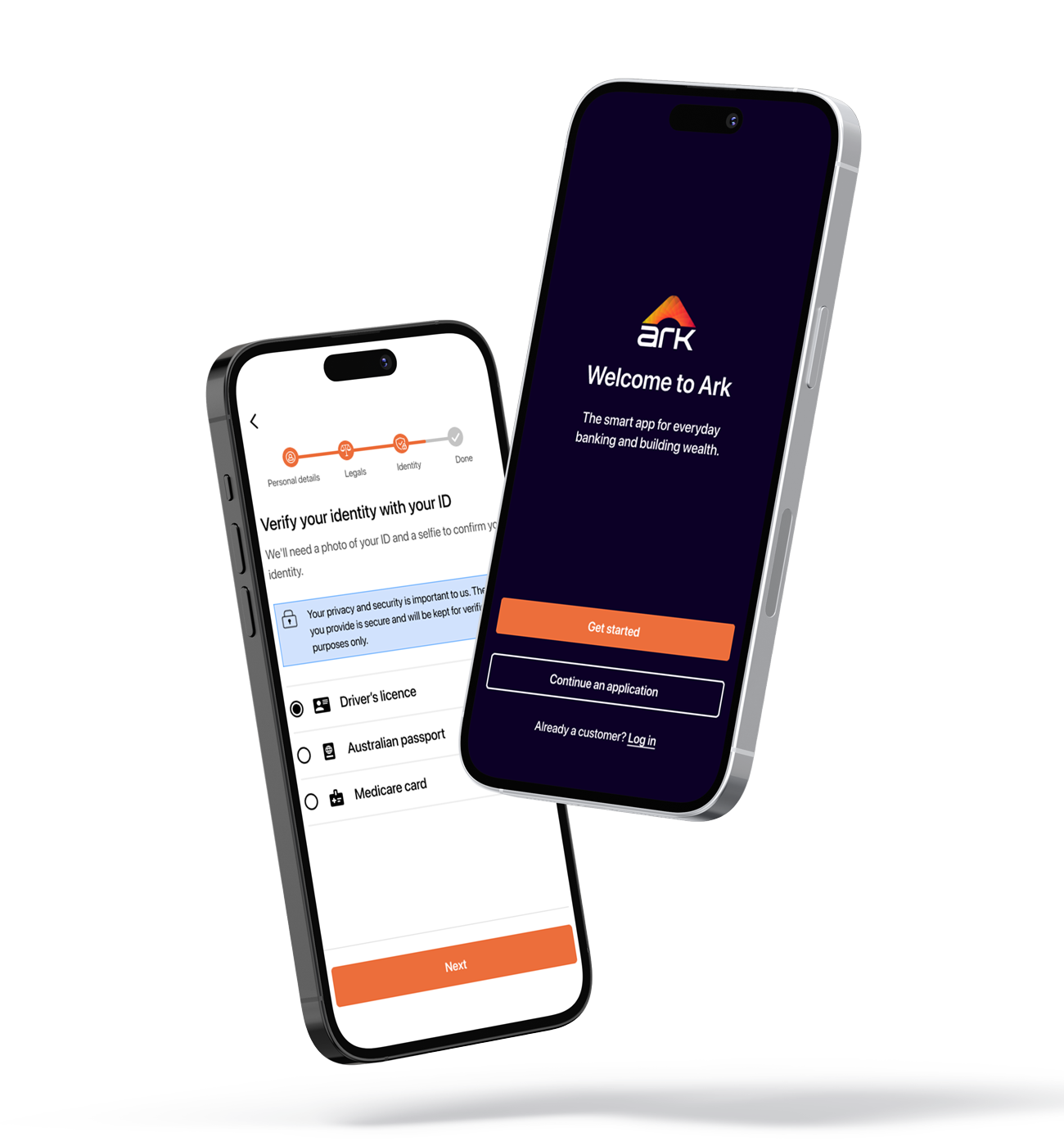

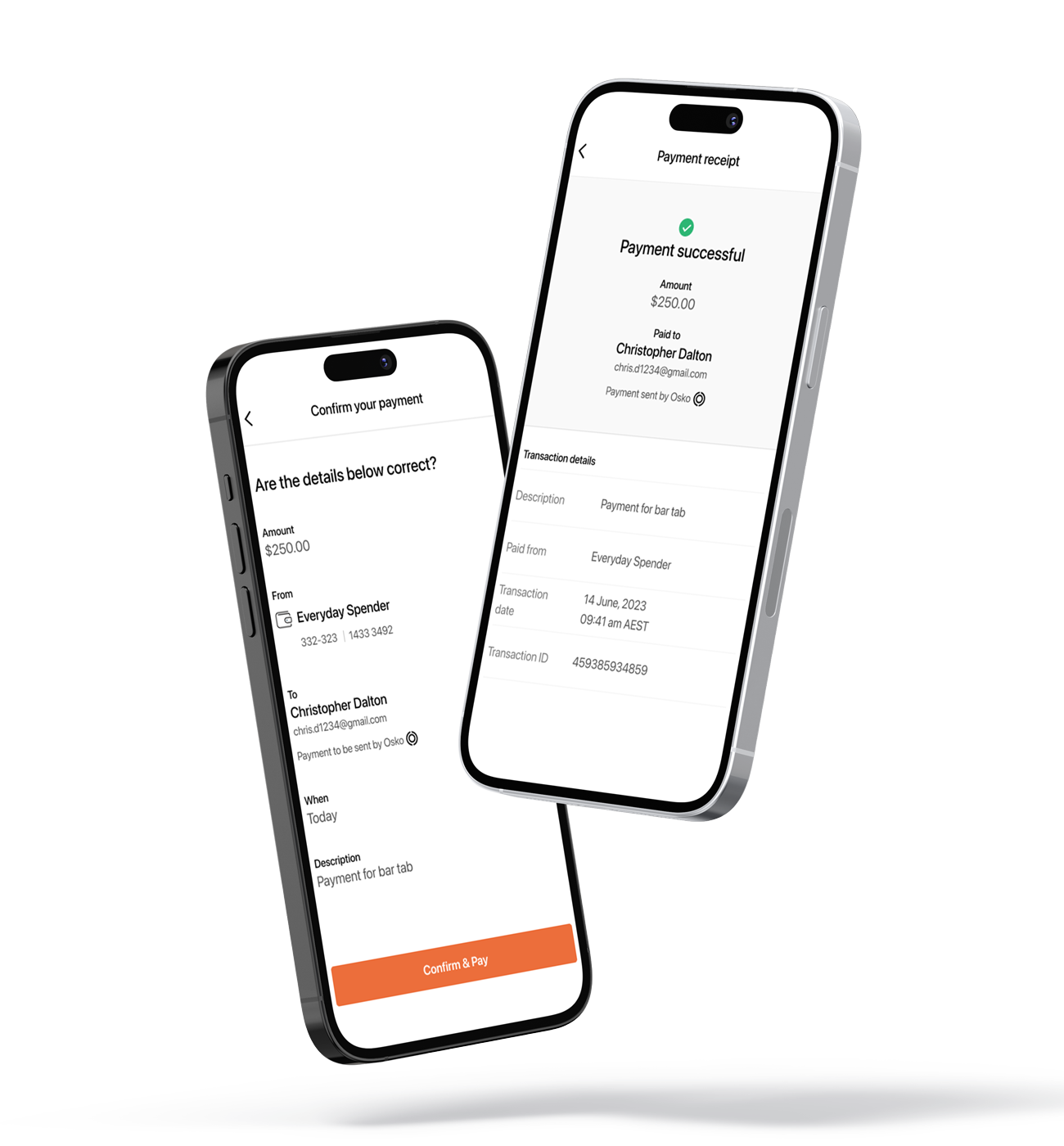

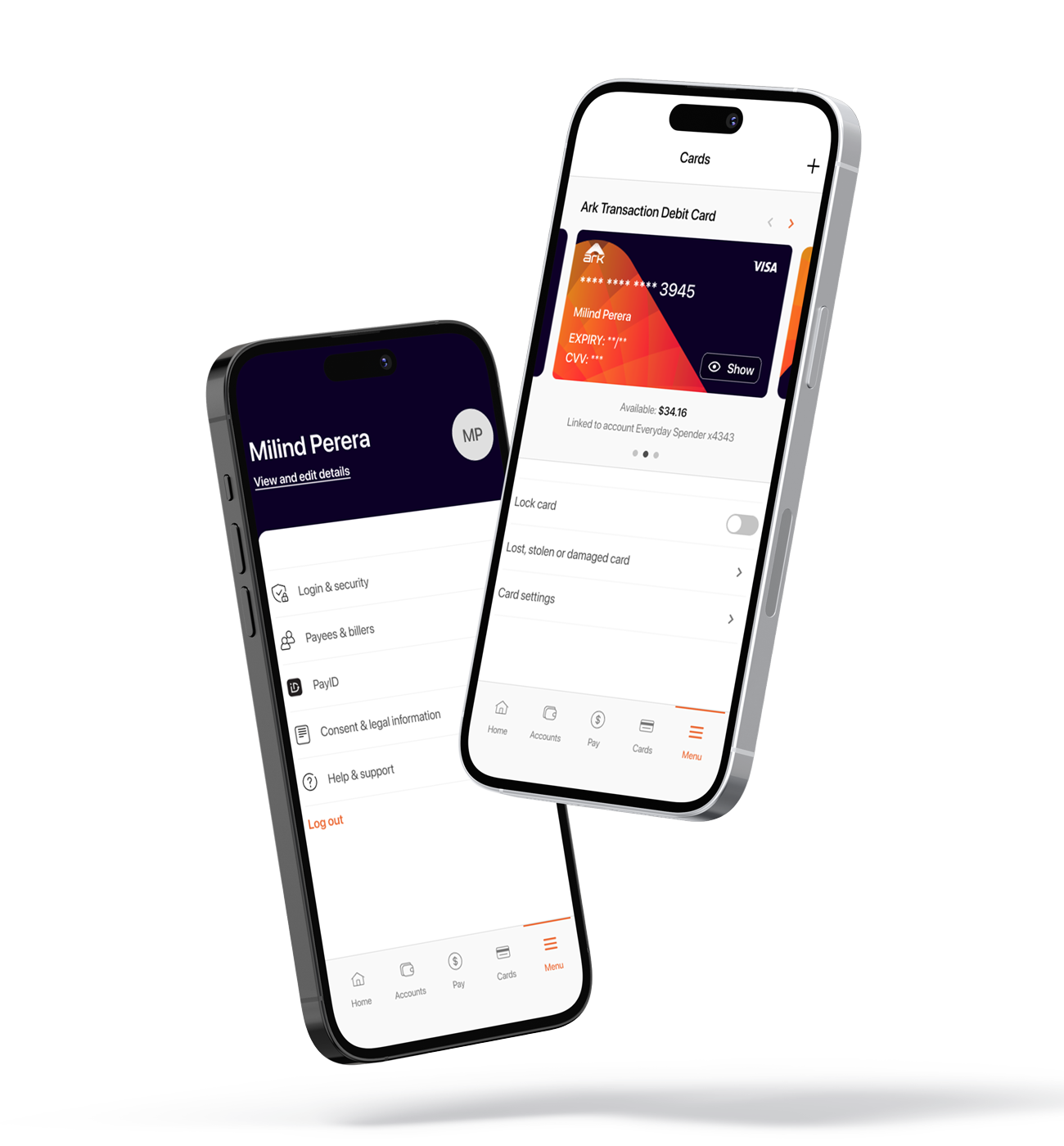

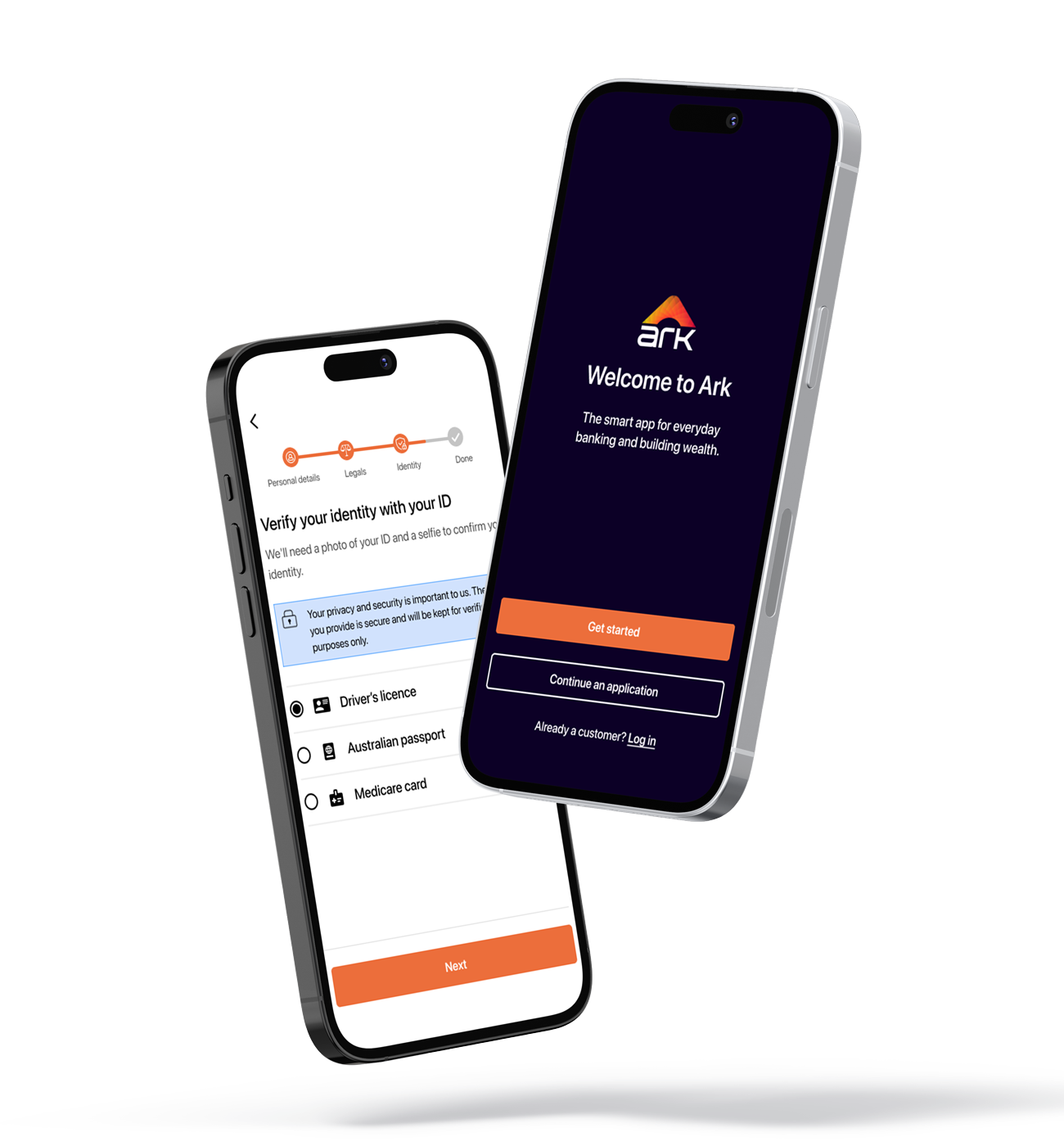

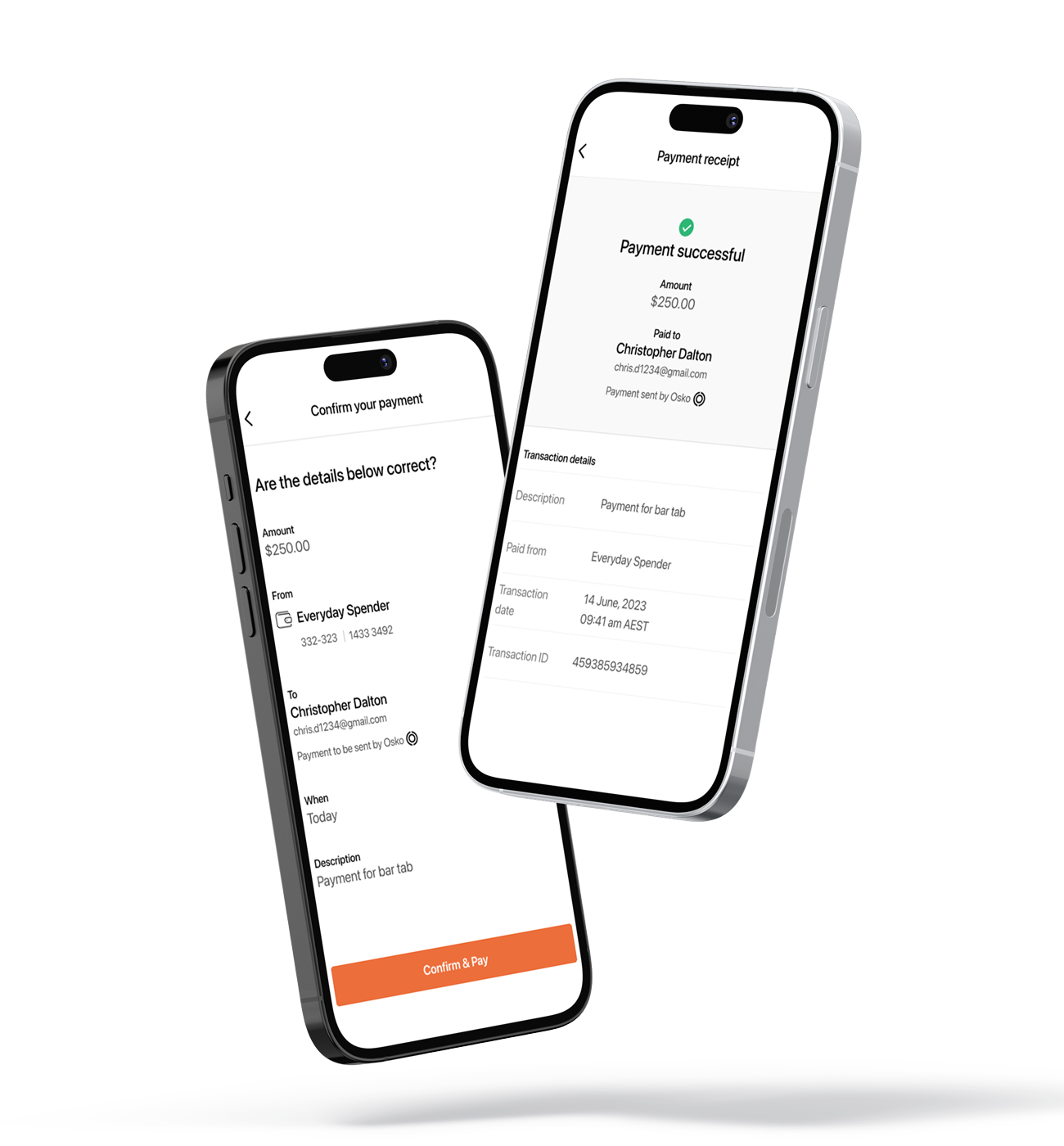

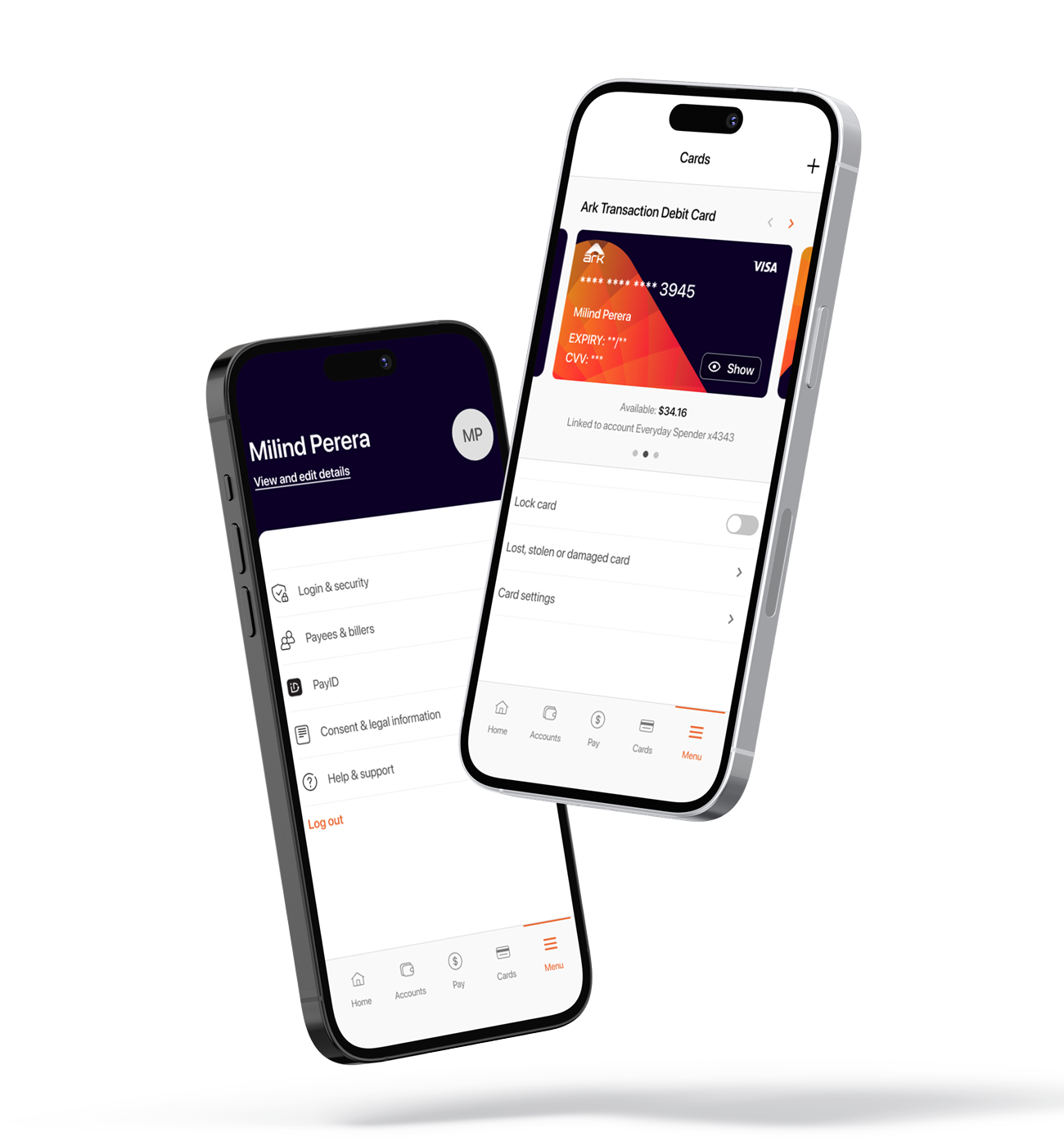

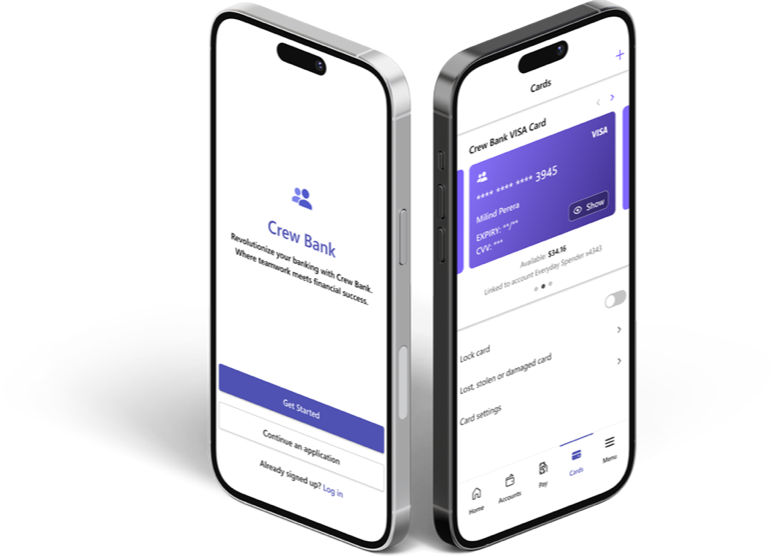

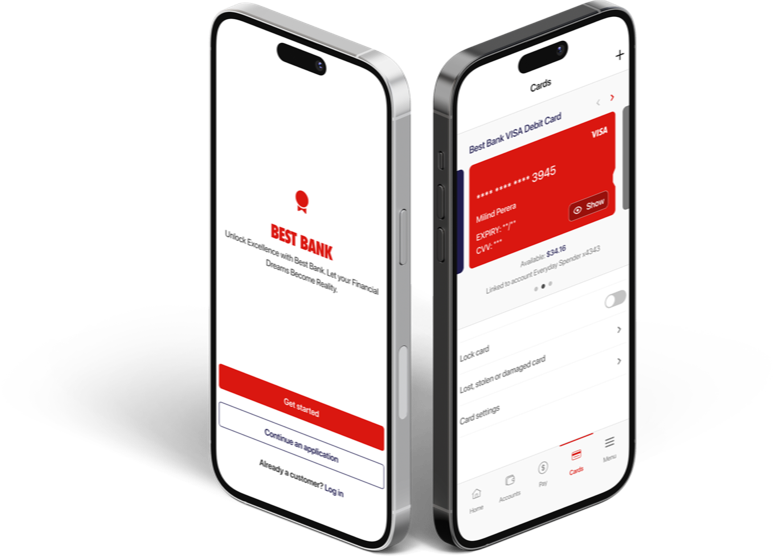

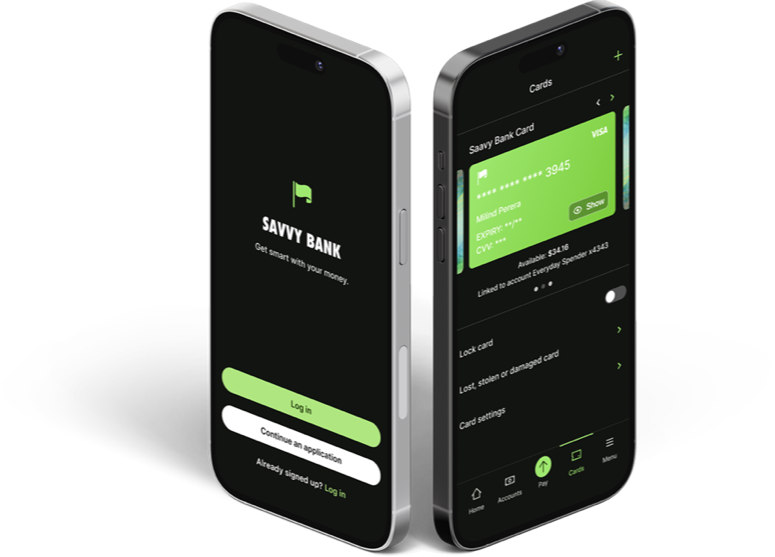

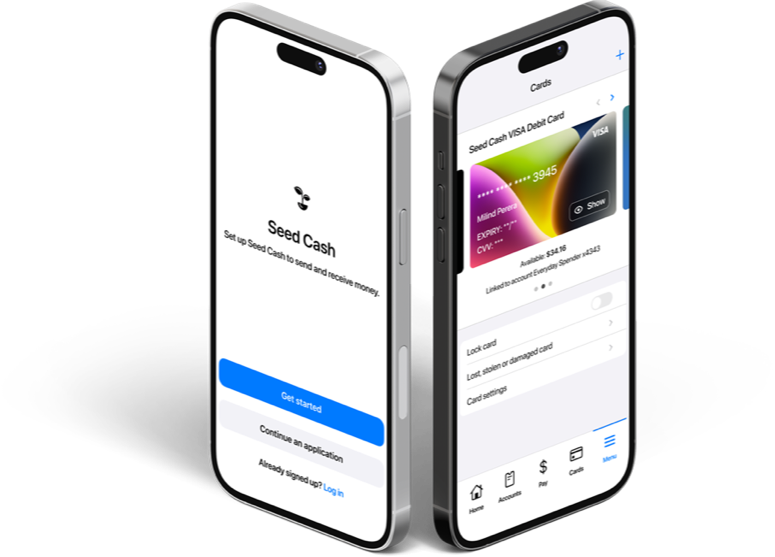

- Pre-built modular foundation – Proven and tested modules for common banking customer journeys

- Highly customisable code – Quickly build new services and features by leveraging code from existing modules

- Modern tech and architecture – Popular, ‘commodity’ tech, a flexible backend and a cross platform hybrid app